After experiencing the sudden economic downturn from the COVID-19 pandemic, the automotive parts manufacturing industry still has plenty of new hurdles to overcome. Semiconductor shortage, high raw material costs, supply chain issues, and increasing sustainability concerns are the recent detractors. However, time and again cutting-edge technological advancements such as AI and their integrations into ERP software prove their value in transforming the industry.

In this two-part blog series, we will dive into the recent findings about the automotive parts industry to understand the potential innovation can have when combined with the right IT staffing solutions. The latest ERP software combined with ERP professionals that have automotive industry specific knowledge and experience can accelerate the journey towards a tech-driven future. Now, before we get into how this ERP combination streamlines auto parts manufacturing processes, let’s explore what’s shaping this ecosystem.

Automotive Parts Manufacturing Industry is in a Grey Area

In 2024, the projected revenue of the U.S. automotive parts, accessories, and tire stores will amount to $92.3 billion, according to industry forecasts by Statista. However, it is worth noting that auto parts manufacturing is a complex ecosystem. It includes the market for auto components, chassis, seatings, electronic parts, mirrors, batteries, cooling systems, lighting, underbody components, and much more. The original equipment manufacturers (OEMs) and after-sales servicing and maintenance are the core revenue drivers of this industry.

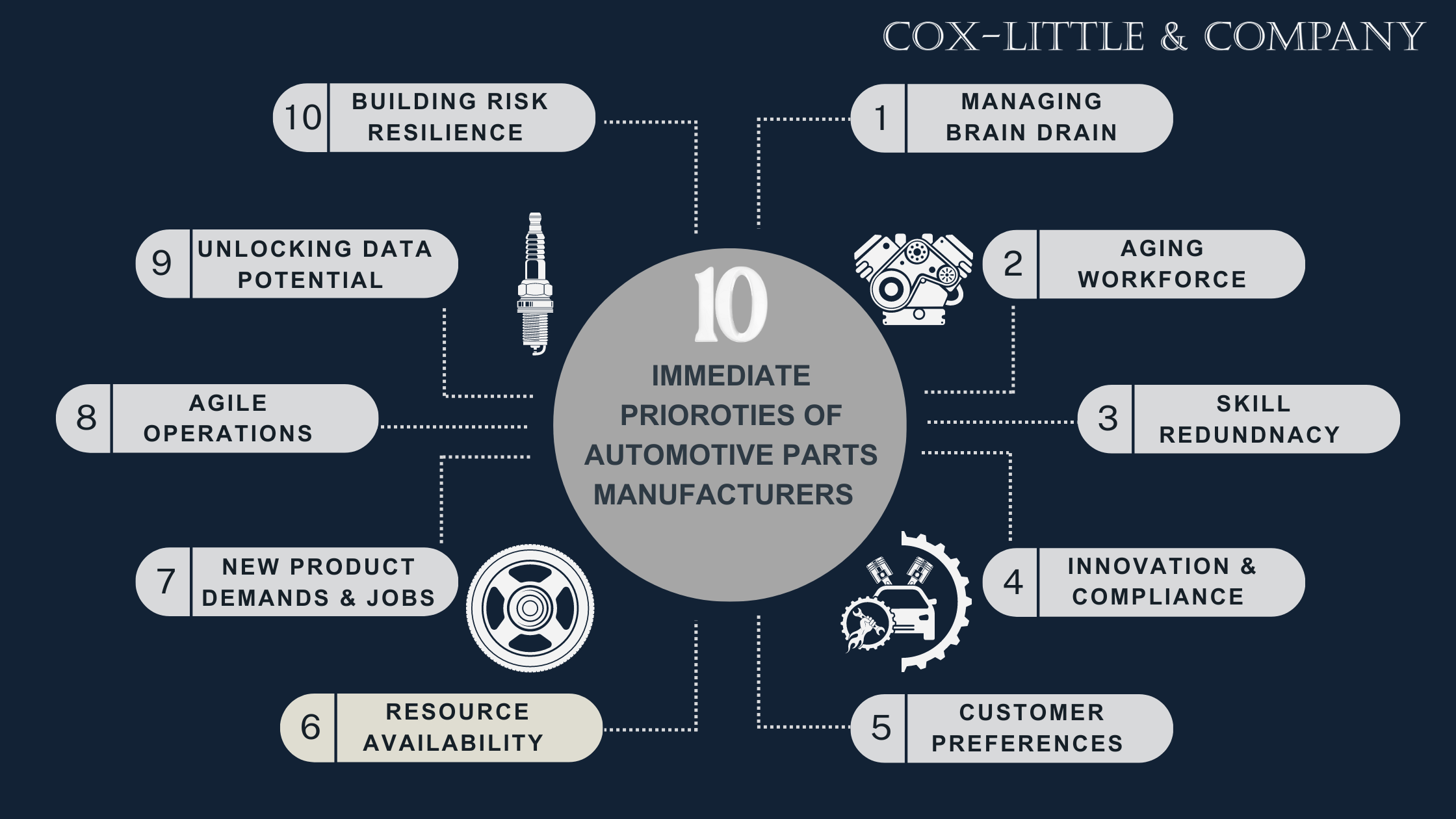

The growth and innovation potential give optimistic hopes for the auto parts industry. However, the manufacturers’ immediate priorities challenge them, leading them to a grey area where the focus on the below becomes paramount.

Ten Pressing Priorities of Automotive Parts Manufacturing Companies in 2024

- Massive Brain Drain: According to a study by the National Automobile Dealers Association (NADA), the job turnover rate in the automotive industry is 40%. Poor compensation is one of the main reasons. The job market was further destabilized due to the mass resignations and layoffs during the pandemic. Bidding farewell to jobs in search of better opportunities and finding ‘meaning in life’ meant the loss of institutional and technical talent.

- Aging Workforce: The recent outlook survey by the National Association of Manufacturers found the automotive industry struggles to retain quality workforce and talent. The aging workforce and gradual retirement of workers from the baby-boomer generation exacerbate the talent crunch in the industry. It may be surprising to know that nearly 25% of the manufacturing workers in this sector are aged 55 and above. A Deloitte study found that more than one-third of organizations are at best, moderately capable of retaining and transferring the knowledge and skills to attract and train young talent.

- Skill Redundancy: Recently, due to the transition to Industry 4.0 and electrification, labor-intensive workflows have become irrelevant. Staying on top of the innovation trends with a great emphasis on profitability and quality operations means that automotive and auto parts manufacturers have an excess of talent and skill that are no longer relevant.

- Product Innovation & Compliance: OEMs and auto parts suppliers must balance product innovation and product compliance in today’s sustainability-conscious times. Product innovation to meet customers’ quality expectations and manufacturability feels like a double-edge sword. Innovation in design, quality, and product development must meet compliance requirements. And keeping up with compliance requirements needs a new angle in product innovation. Understanding where to start is a primary issue for a manufacturer.

- Customer Preferences: Back in the day, auto manufacturers competed for their engineering capabilities. With 60% of car buyers being under 45 and expecting data-rich and online, contactless experiences, auto parts makers must keep notes to put the customers back to driver’s seat. If a vehicle manufacturer wants to invest in electromobility and customer centricity, they must reorient their supply chain, auto parts design, development, manufacturing, sales, marketing, and after-sales strategies. Automakers need to invest enough in research and development and better systems to actively predict trends in supply chains and customers’ mindset shifts. Keeping a customer-focused approach is important to maintain decent profitability and operation margins. That would be an iterative and continuous innovation process.

- Resource Availability: Auto parts manufacturers need to start tracking their requirements when using IoT and smart manufacturing technologies. Finding raw materials, components, and equipment at reasonable rates to support the move from traditional internal combustion engines (ICEs) towards battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs) with uninterrupted access from the suppliers and alternative sources while exploring circular economy models is a huge step. Additionally, supply chains are highly responsive to shifts in the geopolitical, economic, and regulatory climates. Keeping sight of probable risks that impact supply chain and equipment accessibility needs investment in automation and connected technologies.

- New Product Demand & Jobs: While there is a pressing shortage of human resources, the shift from traditional vehicles to electric vehicles and battery-operated mobility will increase new product demand and create new jobs. According to the Economic Policy Institute, electromobility will generate more than 150,000 jobs in the U.S. by 2030. But the only catch is that the U.S. must invest adequately in the auto sector to produce batteries and drivetrain locally. Electric vehicles and assembly will require technical skills for the development of software, data analytics, robot testing, and more.

- Agile Operations: Typically, OEMs implement the waterfall method for product and IT development. The scarcity of resources and components and supply chain disruptions make it costly and challenging to pivot to the next stage. Introducing new product lines, testing them on target markets, and rolling them out to dealerships requires adopting an agile mindset. Agile operating models benefit auto parts makers and OEMs by bringing all stakeholders together and keeping them in line with obstacles, production goals, and important data points to scale product innovations and avoid product recalls.

- Unlocking Data Potential: Many things that can go wrong like inaccurate inventory data, inability to track raw material and production costs, fragmented systems between production, and other departments. Oversights in supply chains and product quality audits lead to failures and poorly planned processes. OEMs can leverage data and analytics as a competitive leg-up. This is where automotive ERP software comes into play by centralizing all the processes and stakeholders. Auto parts manufacturers have to make the most of their data to engage customers, personalize their products and services, and integrate innovative strategies across touchpoints. The pressure to stay data-driven compounds each day.

- Building Risk Resilience: Recent events have pushed every industry to adopt a culture of acceptance of risks with relevant risk management strategies. In auto parts manufacturing, businesses must strengthen their risk appetite across manufacturing processes and operations. It starts with bridging communication and transparency gaps across the supply chain, logistics, production planning, procurement, distribution, and human resources. Investments in AI-powered tools and systems like ERP can help identify new ways to scale the business and human efforts to keep up with supply and demand pressures and market volatility. AI tools enable predictions to expose weaknesses and risks to proactively implement risk-resilient approaches.

We have already gone over the ERP advantage to streamline automotive parts manufacturing processes, improve the supply chain, and optimize resource allocation. To fuel growth, ERP is a transformative catalyst. Stay tuned for the upcoming blog for industry-level insights on addressing the talent needs of auto parts manufacturers using Cox-Little & Company’s staffing solutions to source hard-to-find ERP and other IT professionals.

In the meantime, talk to our team to check if your current ERP staffing can address your long-term business and profitability goals.

Leave A Comment